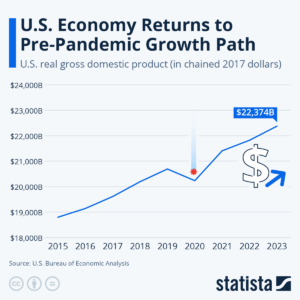

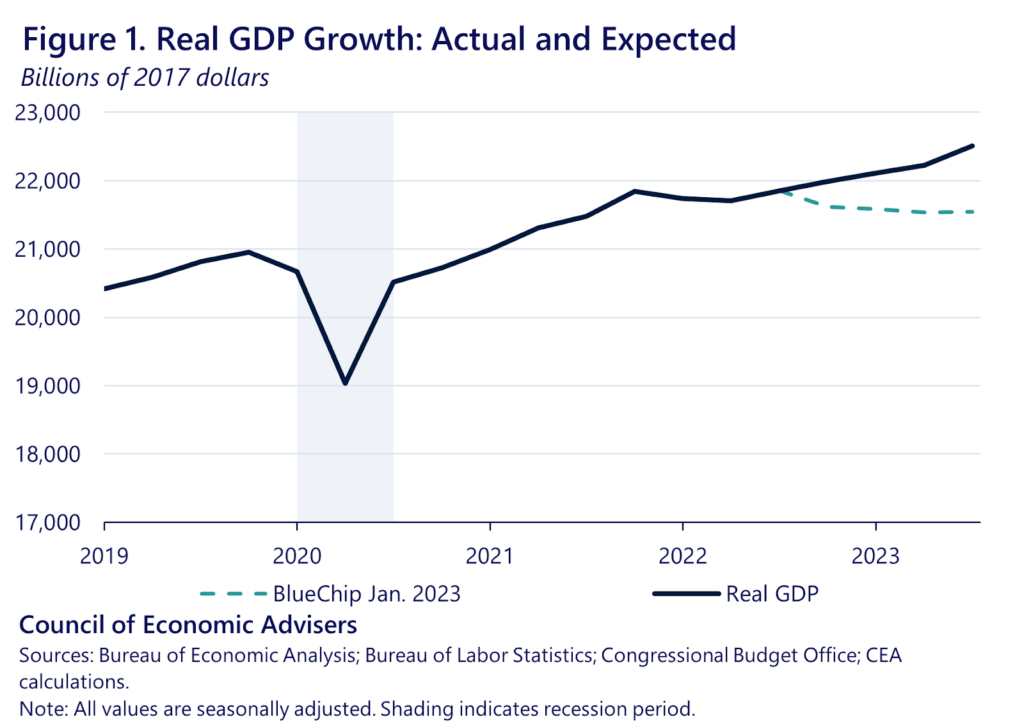

The U.S. economy has quietly staged a sharp rebound—registering a 3.8% annualized growth in Q2 2025 after a contraction earlier in the year. While headlines focus on inflation and jobs, the real story lies in how consumer spending, business investment, and shifting trade flows are reshaping the economic landscape. This article dives into what’s happening, why it matters, and how you can respond.

What Really Happened in the U.S. Economic Turnaround?

At first glance, the headline figure of 3.8% GDP growth in Q2 2025 stands out. (BEA) This follows a 0.6% contraction in Q1. (BEA)

Several factors contributed:

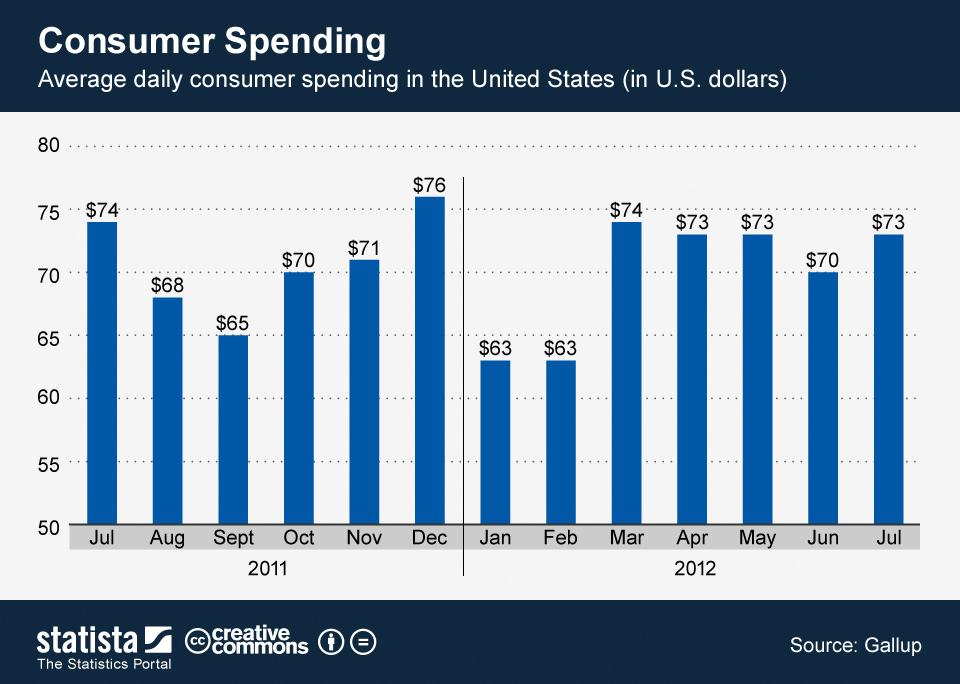

- Consumer spending picked up: After weak growth, personal consumption expenditures surged. (US Bank)

- Imports fell: A reduction in imports boosted headline GDP numbers. (Reuters)

- Business investment surged: Spending on equipment and intellectual property, including software and AI, increased. (Reuters)

- Stabilizing labor markets: Continued employment and wage growth supported consumption and investment. (U.S. Treasury)

The result is a rebound that is both real and meaningful—reflecting stronger fundamentals across key sectors.

Why You Should Care

This turnaround affects more than macroeconomic statistics—it has direct implications for jobs, savings, investments, and household finances.

- Jobs & wages: Businesses may expand hiring and increase wages in response to stronger growth.

- Costs & purchasing power: Inflation and interest rate changes influence loans, mortgages, and credit availability.

- Business & investment opportunities: Entrepreneurs and investors can capitalize on rising consumer spending and tech adoption.

- Household budgets: Price changes in goods, services, and credit affect daily life.

Key Questions Americans Are Asking

1. Why did the economy rebound so sharply?

The rebound is due to a combination of increased consumer spending, reduced imports, and stronger business investment. (Reuters)

Takeaway: Some of the surge reflects structural improvement; some is an accounting effect.

2. Are we out of economic danger?

Not entirely. Structural risks like trade policy, inflation pressures, and labor market constraints remain. (Deloitte)

3. What does this mean for inflation and interest rates?

Rising growth may pressure the Fed to maintain or increase interest rates to manage inflation. (NY Post)

4. Will job prospects improve?

Potentially, particularly in consumer-driven industries, technology, and manufacturing.

5. Is this rebound broad-based?

Partially. Consumer spending and investment rose, but exports and some investments lag. (BEA)

6. How should savers and investors respond?

Stronger growth may improve returns but increases inflation and credit risk. Focus on sectors benefiting from growth.

7. What about households with debt?

Variable-rate debt may become more expensive. Refinancing or paying down high-interest debt can mitigate risk.

8. Does this reduce the risk of recession?

Short-term risk is lower, but vulnerabilities remain. (U.S. Treasury)

9. How should small business owners react?

Expand cautiously, invest in productivity (automation, AI), manage costs, and maintain liquidity.

10. What should everyday Americans do now?

- Review budgets, accelerate savings, and reduce high-interest debt.

- Upskill for sectors aligned with growth.

- Monitor investments and consider growth-aligned opportunities.

Trending FAQ: 10 Popular Questions

Q1: What triggered the 3.8% GDP growth?

Increased consumer spending, reduced imports, and business investment. (Reuters)

Q2: Is inflation gone?

No. Inflation drivers persist, including labor costs and supply-chain disruptions.

Q3: Are job opportunities rising?

Yes, particularly in tech, manufacturing, and consumer-driven sectors.

Q4: How will interest rates react?

Rates may stay elevated due to growth and inflation pressures.

Q5: Is the turnaround real or a statistical anomaly?

It’s both: real growth combined with import-based accounting effects. (Investopedia)

Q6: Which sectors benefit most?

Tech, services, consumer goods, and business equipment.

Q7: Do low-income households benefit?

Benefits may be delayed; wage growth can lag GDP recovery.

Q8: Should I invest now?

Yes, cautiously. Diversify and focus on sectors benefiting from growth.

Q9: Is long-term growth sustainable?

Potentially, but structural challenges remain (demographics, productivity, trade).

Q10: Does this eliminate recession risk?

No. It lowers short-term risk but external shocks or internal vulnerabilities could still trigger downturns.

Real-Life Examples

- A Midwestern equipment producer saw a surge in orders in early 2025 due to business investment trends.

- A Florida household with variable-rate mortgage refinanced after indicators of stronger growth.

- An Austin tech firm expanded its AI development team in response to increased investment in software and tech.

- A Northeast retailer reported a spike in service-sector sales, aligning with consumer spending data.

Practical Advice

Key Indicators to Watch

- GDP growth and quarterly revisions

- Consumer spending and durable goods orders

- Business investment in equipment and intellectual property

- Import/export and trade balance data

- Labor market data: job growth, unemployment, labor force participation

- Inflation measures and Federal Reserve communication

Recommended Actions

Individuals: Review budgets, pay down debt, build emergency savings, and align investments with growth trends.

Job Seekers: Target sectors aligned with investment and spending growth; upskill accordingly.

Business Owners: Expand cautiously, invest in productivity, maintain liquidity, monitor costs.

Investors: Focus on sectors benefiting from growth, diversify, and manage risk in an environment of potential inflation and rate changes.

Final Thoughts

The U.S. economic turnaround is real and meaningful. A 3.8% GDP growth, stronger consumer spending, and rising business investment highlight a shift. Momentum is positive, but risks remain. By making informed decisions—adjusting debt, investing strategically, and aligning with growth sectors—you can benefit from this era of economic recovery.

Understanding the turnaround isn’t optional—it’s essential. Your finances, career, and lifestyle will feel its effects.