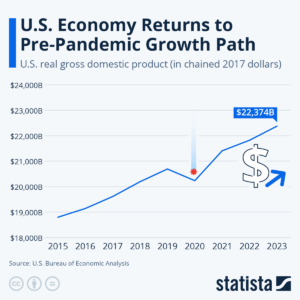

The latest U.S. legislation promises sweeping changes, but many Americans may not realize its deeper impacts. From taxation and healthcare to small-business regulations and technology compliance, these new laws could subtly alter everyday life. This article explores the hidden consequences, practical implications, and actionable steps to help you stay ahead and safeguard your finances, career, and household stability.

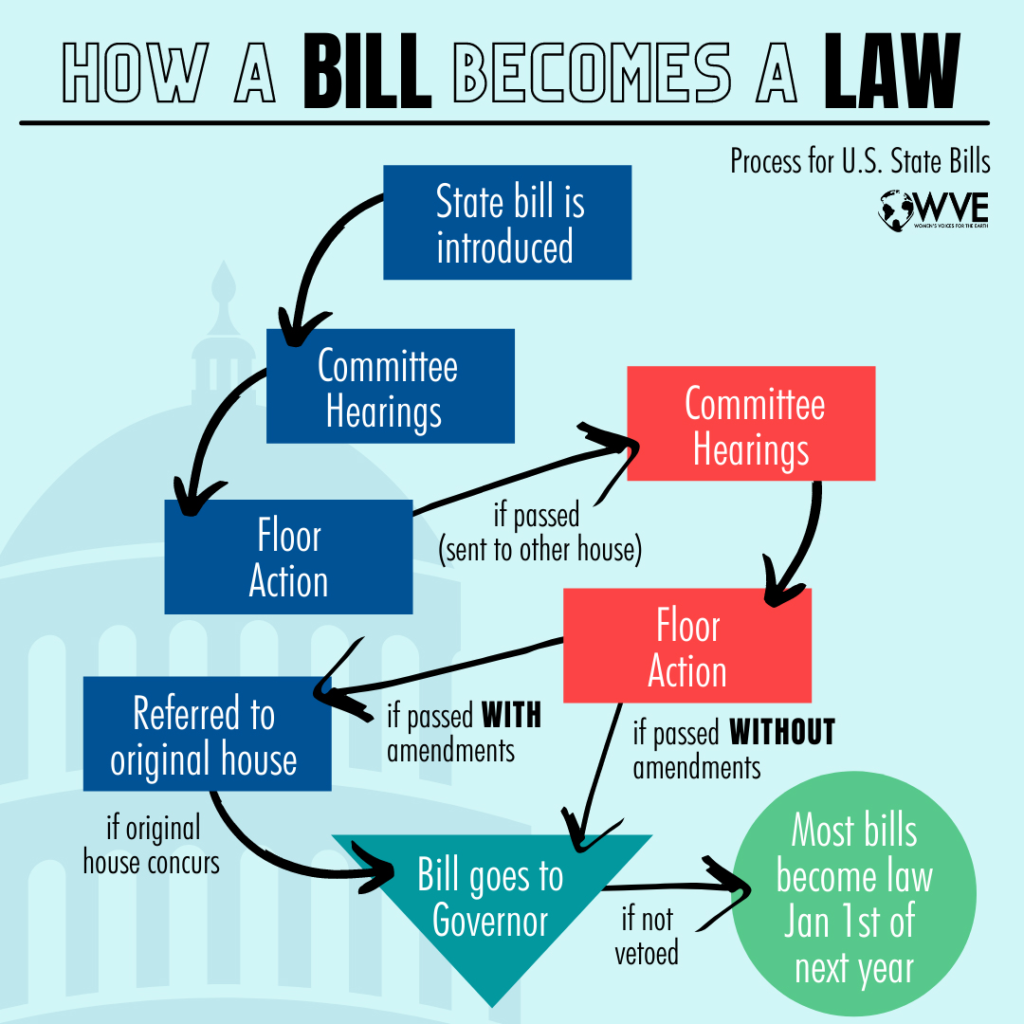

Understanding the New Legislation: Beyond the Headlines

When new laws are passed, the media often focuses on high-profile points: tax breaks, headline reforms, or regulatory updates. However, the unseen ripple effects are equally important. For instance, a seemingly minor change in corporate tax law may indirectly affect employment patterns, product pricing, or investment strategies.

Take the 2025 Infrastructure and Tech Compliance Act as an example:

- Headlines emphasized modernization grants and tax incentives for tech adoption.

- Behind the scenes, smaller businesses face complex compliance requirements, potentially increasing operating costs by 5–12% (Small Business Administration, 2025).

- Individuals in affected industries may encounter changes in retirement plans, benefits, and contract structures.

These nuances often go unreported but can significantly influence financial planning and daily life.

Why This Matters to You

Household Budgets & Personal Finances

Even legislation aimed at corporate or macroeconomic improvements can affect household costs. Examples include:

- Increased utility or service fees due to mandated technology upgrades.

- Shifts in tax brackets or deductions impacting net income.

- Healthcare plan adjustments prompted by new regulatory requirements.

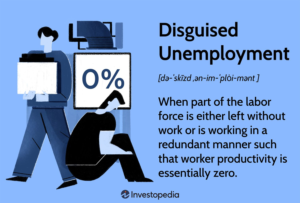

Career and Employment

Professionals in impacted industries might experience:

- Job reclassification or restructuring.

- Increased demand for compliance and regulatory skills.

- Wage adjustments due to altered corporate expenditure priorities.

Small Businesses and Entrepreneurship

Small business owners are particularly vulnerable:

- Higher administrative costs.

- New reporting requirements.

- Potential legal liabilities if compliance is overlooked.

Understanding these dynamics allows proactive planning and reduces financial and operational shocks.

Key Questions Americans Are Asking

1. Which industries are most affected by the new laws?

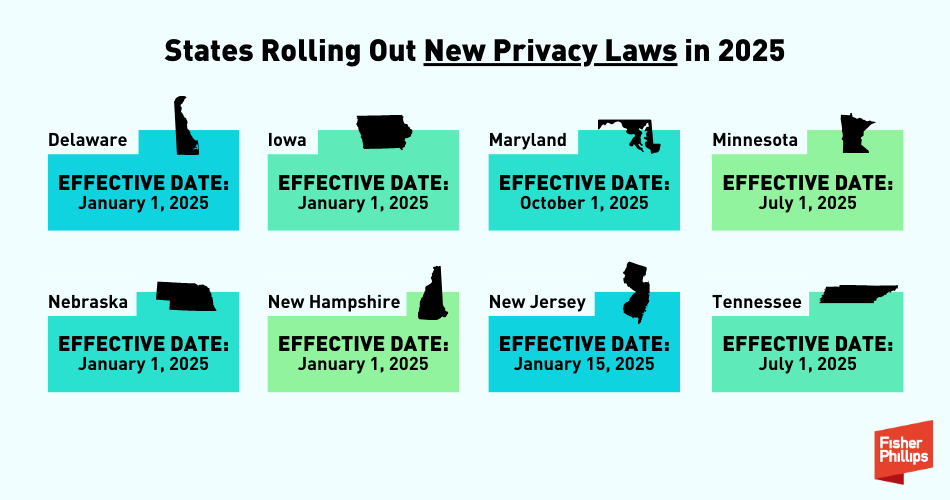

- Technology and compliance-heavy sectors: AI integration, cybersecurity, and data management.

- Construction and infrastructure: New safety standards, project documentation, and local compliance rules.

- Healthcare and insurance: Adjusted coverage mandates and reporting requirements.

2. Will my taxes change?

Yes, there are subtle changes in tax deductions, credits, and corporate pass-through implications. Families may notice differences in itemized deductions or healthcare credits.

3. How will this impact small businesses?

Small businesses may face new reporting obligations and higher compliance costs. Experts recommend software automation and early adoption of reporting tools to minimize disruption.

4. Are there effects on employment law?

Labor classification changes, updated overtime rules, and mandatory reporting on employee benefits are among the key shifts.

5. Should I be concerned about technology compliance?

Yes, legislation often includes cybersecurity standards, data privacy mandates, and digital infrastructure requirements. Businesses and individuals handling sensitive data must comply or risk penalties.

6. How can individuals prepare financially?

- Review household budgets for potential indirect cost increases.

- Adjust investment plans based on sector shifts.

- Track deductions and credits impacted by new tax rules.

7. Are these changes permanent?

Some provisions are temporary (sunset clauses), while others introduce long-term structural shifts. Awareness is critical to long-term planning.

8. How will these laws affect retirees?

Pension and retirement accounts may see adjusted contribution limits, tax implications, or compliance requirements, depending on sector exposure.

9. Are there hidden benefits?

Yes, some incentives may reduce costs in unexpected ways, such as grants for energy efficiency, tax credits for compliance investments, or professional upskilling programs.

10. Where can I get reliable updates?

- Official government websites (IRS, SBA, HHS)

- Trade associations for your sector

- Reputable financial news outlets

- Certified legal and tax advisors

Real-Life Examples of the Unseen Effects

- Small Tech Startup

A San Francisco startup benefiting from modernization grants discovers a mandatory cybersecurity audit, increasing operational costs by 7%, forcing a temporary hiring freeze. - Family Healthcare Plan

A family of four sees slight premium increases as their employer implements new reporting standards to comply with updated healthcare legislation. - Midwest Manufacturing Firm

Compliance with updated safety and environmental standards increases raw material costs by 3%, impacting product pricing and profit margins. - Freelancers and Gig Workers

Independent contractors face tax classification updates, affecting estimated tax payments and retirement contributions.

Practical Steps to Navigate the New Legislation

- Review: Evaluate how the law directly affects your industry or household finances.

- Plan: Adjust budgets, investments, and retirement accounts to reflect potential changes.

- Upskill: Enhance skills in compliance, regulatory management, or new technology mandates.

- Monitor: Track regulatory updates through government portals and trade associations.

- Consult Professionals: Engage financial planners, tax experts, and legal advisors for clarity.

Frequently Asked Questions (FAQs)

Q1: How soon will the unseen effects impact my finances?

A: Many effects are immediate (e.g., tax changes), while others may unfold over 6–24 months depending on sector implementation.

Q2: Are certain states more affected than others?

A: Yes, states with higher corporate density, infrastructure projects, or healthcare facilities may see stronger effects.

Q3: Can small businesses apply for assistance to offset compliance costs?

A: Yes, government grants, low-interest loans, and professional development subsidies are often available.

Q4: Will this affect my retirement contributions?

A: Some sectors may see adjusted limits, especially for self-employed individuals and gig workers.

Q5: Do I need a lawyer to understand the changes?

A: While not mandatory, consulting a legal or tax professional ensures compliance and minimizes risk.

Q6: How can I stay updated on compliance deadlines?

A: Subscribe to government newsletters, trade associations, and regulatory alerts.

Q7: Are there penalties for non-compliance?

A: Yes, they range from fines to operational restrictions, depending on the sector.

Q8: Will this legislation create new job opportunities?

A: Compliance, auditing, and regulatory roles are likely to grow.

Q9: How will technology mandates affect small businesses?

A: Mandatory cybersecurity and data standards may increase costs but improve long-term resilience.

Q10: Can I leverage any incentives for household savings?

A: Yes, energy efficiency credits, healthcare credits, and modernization grants can help reduce expenses.

Key Takeaways

- Hidden impacts often exceed headline effects.

- Stay informed about tax, compliance, and operational implications.

- Proactive planning minimizes disruption and maximizes benefits.

- Utilize professional guidance and digital tools to simplify compliance.