Despite low headline unemployment rates, millions of Americans face a hidden workforce crisis—functional unemployment and under-employment—that leaves them financially insecure, stressed, and trapped in stagnant careers. This article uncovers the truth, explores the underlying causes, examines who is most affected, and provides actionable strategies to navigate this largely overlooked challenge.

What Is the Hidden Crisis Americans Are Talking About?

While official unemployment rates hover around 4%, many Americans remain under-employed or functionally unemployed. This includes people working part-time involuntarily, earning below a livable wage, or holding jobs that fail to utilize their skills.

According to recent studies, the effective under-employment rate may be as high as 24.3%. (Economic Times)

This means millions of Americans feel insecure in their jobs despite technically being employed—a reality shaping mental health, financial security, and long-term career prospects.

Why This Crisis Matters

Financial Stability

Being “employed” does not guarantee the ability to cover basic expenses or save for the future. Many Americans find themselves in jobs that barely cover necessities, let alone provide financial resilience.

Mental Health

Income insecurity and irregular hours contribute to stress, anxiety, and depression. Workers juggling multiple part-time jobs often experience burnout and instability, impacting overall wellbeing.

Career Growth

Jobs with limited advancement opportunities leave workers stuck, preventing them from achieving their full potential. Structural under-employment is a barrier to upward mobility, particularly for younger workers.

Economic Impact

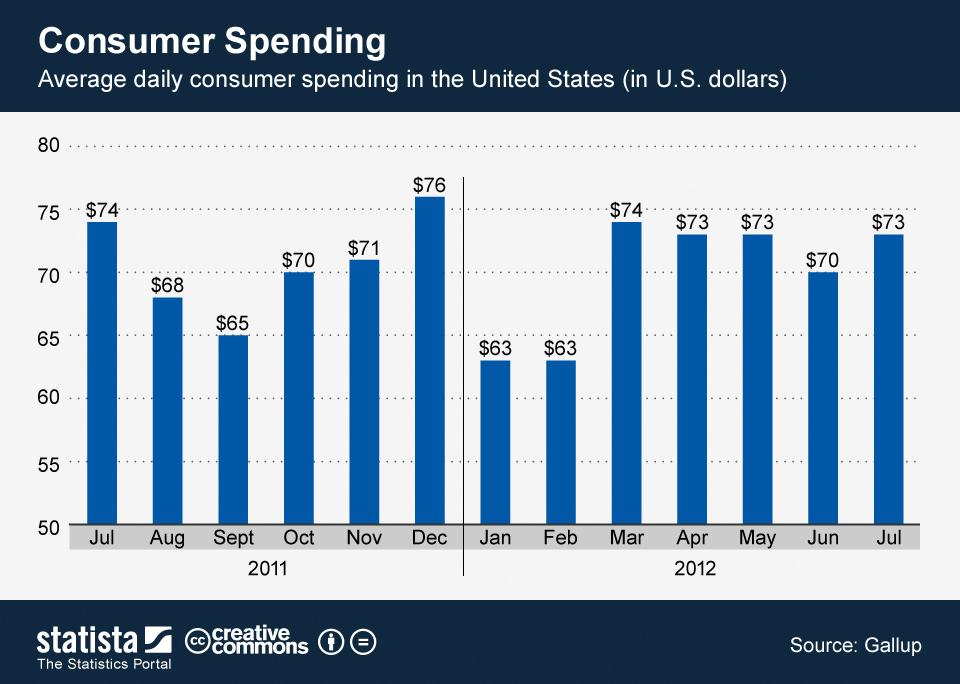

High levels of under-employment dampen consumer spending, reduce productivity, and create social welfare strain—effects not captured by official unemployment figures.

Top Reasons Americans Are Experiencing This Hidden Crisis

- Structural Labor Market Changes: Automation, globalization, and the rise of gig work have altered job availability and quality.

- Pandemic-Driven Shifts: COVID-19 accelerated remote work but also destabilized certain sectors, particularly service and hospitality.

- Wage Stagnation: Despite a tight labor market, wages for many low- to mid-income jobs have not kept pace with cost of living.

- Part-Time & Gig Reliance: Millions are forced into multiple part-time or gig roles to meet financial needs.

- Limited Career Pathways: Jobs in certain sectors provide little opportunity for advancement or skill development.

Real-Life Examples

- Retail Worker: Technically employed but limited to 15 hours/week; relies on three side gigs to cover living expenses.

- College Graduate: Works full-time in a job that doesn’t require a degree; low pay and minimal advancement potential.

- Tech Contractor: Paid on project basis, lacks benefits, faces income uncertainty with each contract renewal.

Frequently Asked Questions (FAQs)

1. What is under-employment and how does it differ from unemployment?

Under-employment refers to workers employed in roles that don’t match their skill level, hours, or wage needs. Unlike unemployment, under-employed individuals are technically working but often financially insecure.

2. Why does the official unemployment rate feel misleading?

Because it excludes those who have stopped looking for work, counts anyone with a job as employed, and ignores job quality and security.

3. Who is most affected by this crisis?

Women, younger workers, people of color, gig economy participants, and those without higher education credentials are disproportionately affected.

4. How long has this crisis been building?

The crisis has deep roots in globalization, automation, and the gig economy, with the pandemic further exposing vulnerabilities in employment quality.

5. What are signs someone is experiencing the hidden job crisis?

- Working multiple part-time jobs

- Earning less than expected

- Feeling stagnant in a role

- Experiencing income volatility

6. Can remote work solve under-employment?

Remote work offers flexibility for some, but it does not fully resolve structural under-employment for roles that must be on-site or offer low pay.

7. How can individuals mitigate the impact?

- Upskill or retrain in high-demand sectors

- Build multiple income streams

- Negotiate for stable hours and benefits

- Maintain an emergency fund

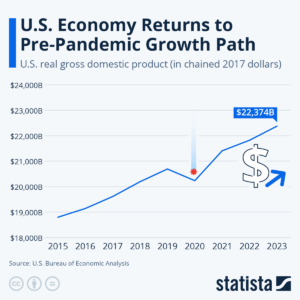

8. Will the crisis improve when the economy recovers?

Not automatically. Without structural reforms like wage growth, job protections, and skill development, under-employment can persist even in strong economies.

9. What can policymakers do?

- Track under-employment and job quality

- Raise minimum wage and enforce living wage laws

- Support retraining and workforce development programs

- Encourage full-time employment over precarious gig work

10. Where can I find reliable data?

- U.S. Bureau of Labor Statistics (U-6 rate)

- Economic research institutes and think tanks

- Government reports on labor force utilization

Practical Advice & Takeaways

- For Individuals: Evaluate your job for security, wage adequacy, and growth. Upskill and diversify income where possible.

- For Households: Maintain 3-6 months of emergency savings and plan for potential income fluctuations.

- For Career Planning: Target sectors with high demand, stability, and advancement opportunities.

- For Policy Advocates: Promote transparency in job quality metrics and support workforce development initiatives.

Final Thoughts

The hidden workforce crisis is not about the lack of jobs—it’s about the lack of secure, well-paying, and fulfilling jobs. Millions of Americans are quietly struggling under the surface of the labor market, making this a critical issue to recognize and address. By understanding this crisis, assessing your personal situation, and taking proactive steps, you can navigate uncertainty and position yourself for stability and growth.